If you feel like you don’t get paid enough, join the team! As someone who’s increased their annual salary over time I can relate to this. Creating a budget seemed impossible and confusing. I feel like when I worked two to three jobs making less than the average American salary, stayed in a apartment, trying to feed three kids, a stay at home wife and struggled to get ahead, I had money issues. Now that I make more than an average American salary with one job, have my own home, multiple cars, feed three kids and a stay at home wife, I don’t feel much better. Why is that? Much can be attributed to budgeting. However, there’s a big difference in where the money is going. I used to struggle saving money. It wasn’t until I decided to get into the niche trade of transportation that my income raised to take care of my families needs from one job. I fell into the trap of thinking I could get multiple streams of income by working multiple jobs. I didn’t realize that this was not a smart way to operate long term. So if you have a family and not enough income regardless of the following I will mention, you need a different career trajectory. Find something your interested in and research the earning potential for that field. If you like what you are doing now, no problem, just work on being the very best at it no matter the wage and let the people in charge know you want to get in a better position to grow with the company. Even if your company requires a degree, for the right worker exceptions can always be made. If you research your field enough and can show you know more than the person above you (without seeming like you want to take their job), who wouldn’t advance them? Help the company make more, they usually help you make more! Get that income up!

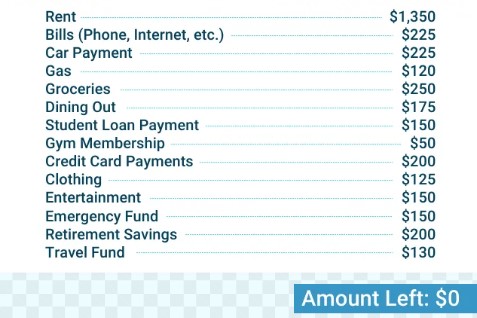

Now, if you need to find somewhere to start to make a budget, this is where we are going: A zero based budget. This means your check is spent, on paper, before you even get it. The reason I recommend and use this budget is because I can quickly see what I know I have spent and then make adjustments with what is left. Most of us all have a housing expense, utilities, grocery, clothing and transportation needs. This is our basic living needs. Everything after this is a want! It is hard to make the basics decrease if needed, so if these are hard to fit within your salary, you need to work on income or possibly moving, because math is just math (if you eat out daily or weekly , check my blog on ‘The Restaurant Trap’. If you have been in the same place for more than a year, you can average these expenses. Add up the total amount you pay each month and divide by twelve. If you feel like some expenses are rising in the future and want to plan for it, add five to ten percent. Examples could include insurance, groceries ( definetly shifted my budget! ), fuel, etc. You may need to revisit the budget at least once a month to keep up with new expenses or adjustments in salary and bills.

Whatever is left over from your needs will tell you what else you can afford. So for easy numbers, lets say you make $2K a month take home pay. That’s after taxes and any deductions your employer may take out of your check. This is low, but hopefully you don’t need to feed a family or you should get another job or perhaps a spouse works. Within that, you’ve taken out $500 for rent (if your single or creative, you can still get rent this low today! Will probably create a blog on this), $400 for groceries, $200 for utilities, and $150 for transportation. This will leave you with $750 at the end of the month. You shouldn’t need clothing every month, so just average a decent amount you want to take out for that. In this example, we will take out $50. That leaves you with $700! What do you want to spend the rest on? I would suggest saving a minimum of 15% of that $2K, which is $300. I used to say use that money to get started on a retirement plan. However, today, I would suggest in this hypothetical scenario that a third ($100) goes to an investment you will never touch and the other two quarters ($200) go to improving yourself. This could be in the form of educational, trade school, online course or personnel development plan. The idea is just to get in a position you really want career wise. Old phrase, invest in yourself! If you make way more, this may not apply to you. You may want to put it on a down payment for a house, a business or something else needed. I just would suggest not to spend it on things like liabilities (check out my blog on ‘Turning Liabilities Into Assets’ for more on that).

Now, I didn’t cover things like debt with cars, medical or anything else that could effect your numbers very much. I will right more articles later about dealing with that. I do want to stress, however, that a budget only works if you stick to it. You get to choose where the money goes after your needs. Just try to include things you know happen every year and divide by twelve what you want to spend on that as well. Our birthdays, Christmas, anniversaries, etc. are not unexpected events. You may have a favorite hobby you want to put in there, a club you participate in, extended family you take care of. Whatever it is, when you finished adding it all up, your budget should be zero, not negative! A negative budget always leads to a spiral in debt. You didn’t need those shoes or car that broke your budget! If you can’t fit, you can’t get! Even if you are expecting a bonus, it is better to be on the side of caution and base your budget on your regular salary than something that can change at the last minute (especially in this economy).

In conclusion, creating a budget is easy. This is how I do mine every month. Having a little above average income gives me everything my family needs, but I could always use more, but I know where the money is going, because I planned it! Staying on a budget is what makes it hard. Life happens, urges happen, sales events, you name it. The best part, you can add categories into the budget to cover those things! Literally name it that thing you think will come up and allocate a certain amount to save for it. I have a car repair tag in my budget. Because all my cars are paid for and older, I know they will require repair at some point. So, I put it in the budget. Cool part is, If it gets big enough and I still have no repairs needed, I have the money to buy another car if I choose to do so! I hope you found value in this article. If so let me know. If someone you think can benefit from this please share! I’m happy to help anyone I can that has issues around this topic of budgeting, so please let me know what you want to talk about! Have a great day!